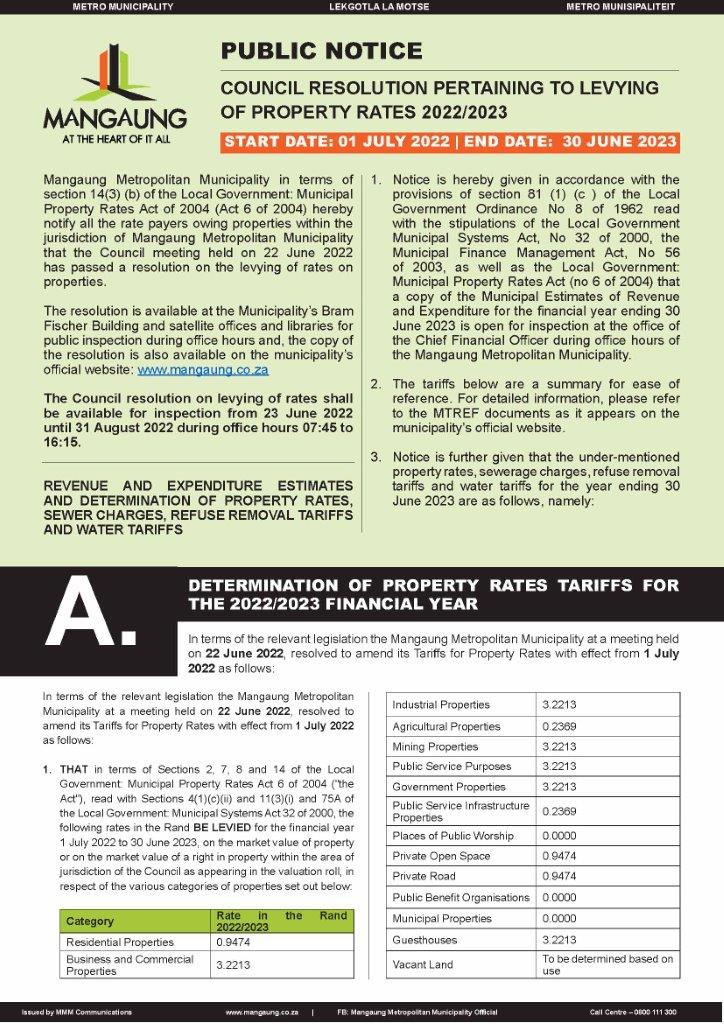

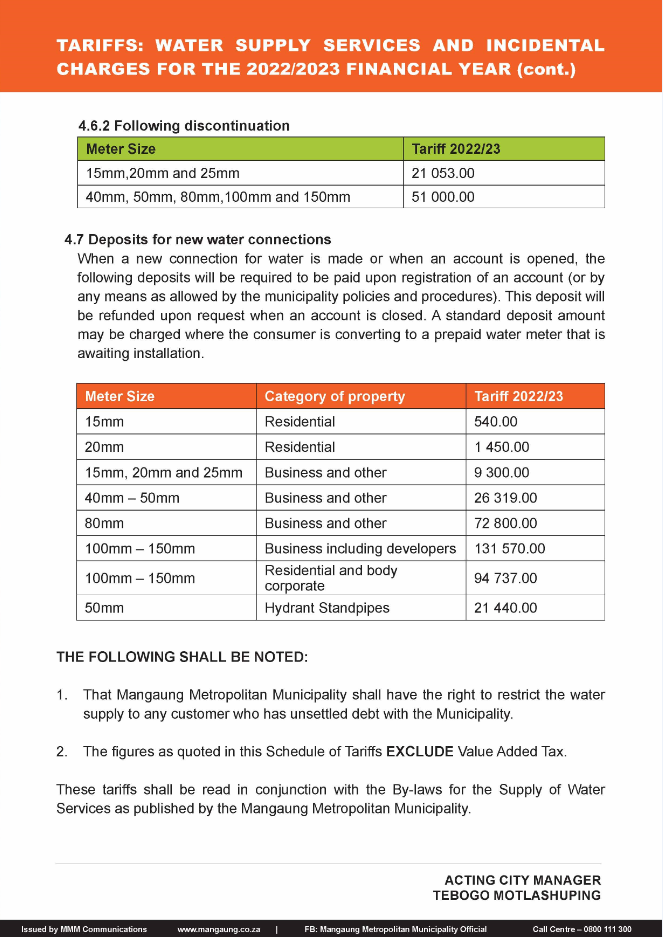

Property Rates, Taxes & Tariffs: 2022 – 2023

Mangaung Metropolitan Municipality in terms of section 14(3) (b) of the Local Government: Municipal Property Rates Act of 2004 (Act 6 of 2004) hereby notify all the rate payers owing properties within the jurisdiction of Mangaung Metropolitan Municipality that the Council meeting held on 22 June 2022 has passed a resolution on the levying of rates on properties; and the resolution is available at the Municipality’s Bram Fischer Building and satellite offices and libraries for public inspection during office hours and, the copy of the resolution is also available below:

The Council resolution on levying of rates shall be available for inspection from 23 June 2022 until 31 August 2022 during office hours 07:45 to 16:15.

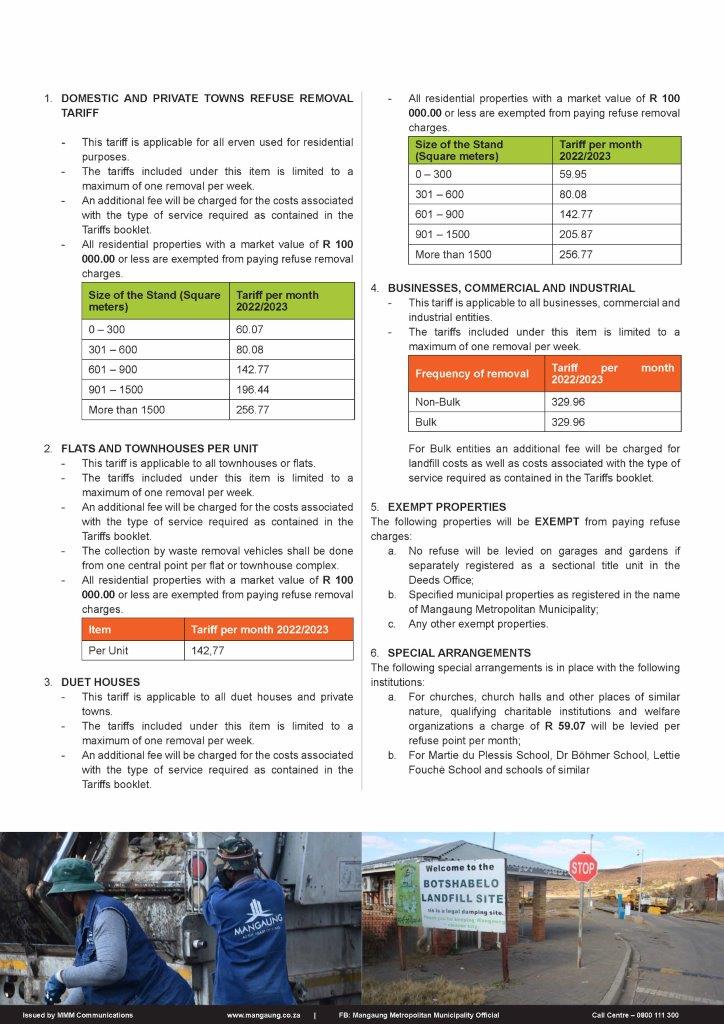

PLEASE NOTE THAT THE CHANGES IN THE TARIFFS ARE DOMESTIC REFUSE REMOVAL FOR 901 – 1500 MUST BE R196.44, AND THE REFUSE REMOVAL FOR DUET AND PRIVATE TOWNS 0-300 MUST BE R59.95

- Click here to download the printer-friendly version of the document as seen below on the LEVYING OF PROPERTY RATES 2022/2023

- Click here to download the PDF on Tariffs: 2022-2023

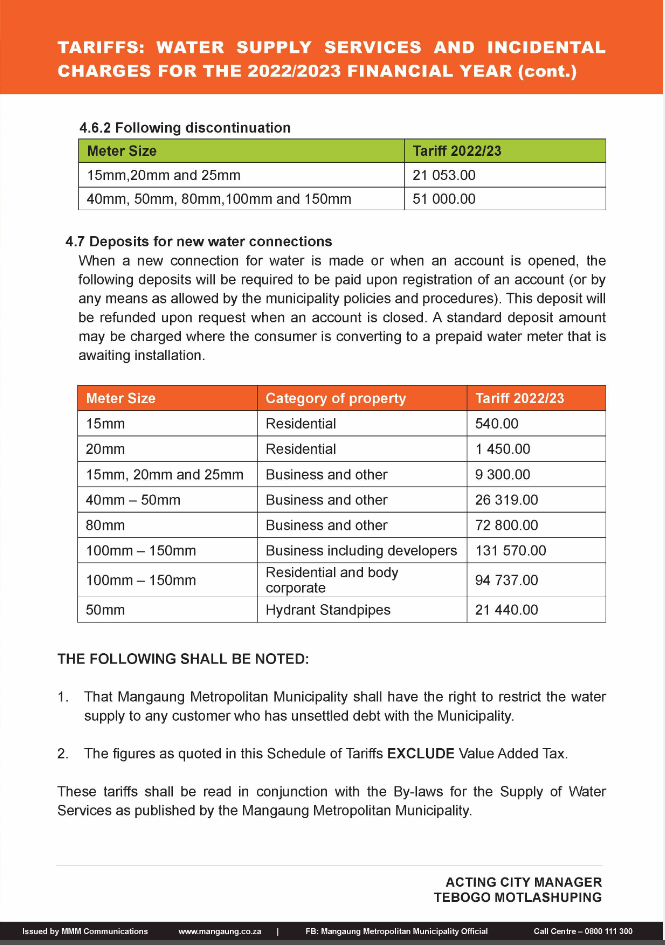

T Motlashuping – Acting City Manager